Why traders still pick MT4 over newer platforms

MetaQuotes stopped issuing new MT4 licences some time ago, pushing brokers toward MT5. Still, most retail forex traders stayed put. The reason is not complicated: MT4 does one thing well. More than a decade's worth of custom indicators, Expert Advisors, and community scripts only work with MT4. Migrating to MT5 means porting that entire library, and the majority of users don't see the point.

I've tested both platforms side by side, and the differences are less dramatic than the marketing suggests. MT5 adds a few extras including more timeframes and a built-in economic calendar, but the charting feels very similar. Unless you need MT5-specific features, there's more articles no compelling reason to switch.

Getting MT4 configured properly the first time

Downloading and installing MT4 is the easy part. The part that trips people up is configuration. Out of the box, MT4 loads with four charts tiled across one window. Clear the lot and open just the markets you actually trade.

Templates are worth setting up early. Set up your preferred indicators on one chart, then save it as a template. From there you can apply it to any new chart in two clicks. Minor detail, but over months it saves hours.

A quick tweak that helps: go to Tools > Options > Charts and enable "Show ask line." By default MT4 displays the bid price by default, which makes entries appear wrong by the spread amount.

How reliable is MT4 backtesting?

The strategy tester in MT4 lets you run Expert Advisors against historical data. Worth noting though: the accuracy of those results comes down to your tick data. Built-in history data is not real tick data, meaning gaps between real data points are estimated using algorithms. If you're testing something more precise than a quick look, you need real tick data from a provider like Dukascopy.

The "modelling quality" percentage tells you more than the bottom-line PnL. Below 90% suggests the results are probably misleading. I've seen people post backtest results with 25% modelling quality and wonder why live trading looks different.

The strategy tester is one of MT4's stronger features, but it's only as good as the data you give it.

Building your own MT4 indicators

MT4 comes with 30 default technical indicators. The average trader uses maybe a handful. But the platform's actual strength comes from community-made indicators written in MQL4. There are a massive library, covering everything from tweaked versions of standard tools to full trading dashboards.

The install process is painless: drop the .ex4 or .mq4 file into the MQL4/Indicators folder, refresh MT4, and it appears in the Navigator panel. The risk is reliability. Free indicators range from excellent to broken. A few are well coded and maintained. Many are abandoned projects and will crash your terminal.

When adding third-party indicators, look at when it was last updated and if people in the forums have flagged problems. A broken indicator won't just give wrong signals — it can lag your entire platform.

The MT4 risk controls you're probably not using

You'll find some risk management tools that the majority of users don't bother with. The most useful is the maximum deviation setting in the trade execution window. This defines how much slippage you're willing to tolerate on market orders. If you don't set it and you're accepting whatever price comes through.

Stop losses are obvious, but the trailing stop function is overlooked. Click on an open trade, choose Trailing Stop, and enter your preferred distance. The stop follows with the trade goes your way. It won't suit every approach, but for trend-following it takes away the temptation to sit and watch.

These settings take a minute to configure and they remove a lot of the emotional decision-making.

Expert Advisors — before you trust a robot with your money

Automated trading through Expert Advisors attract traders for obvious reasons: define your rules and let the machine execute. In practice, a huge percentage of them fail to deliver over any extended time period. The ones marketed using perfect backtest curves are usually curve-fitted — they worked on the specific data they were tested on and fall apart when conditions shift.

None of this means all EAs are useless. A few people build their own EAs for specific, narrow tasks: opening trades at session opens, calculating lot sizes, or exiting positions at set levels. These utility-type EAs tend to work because they do repetitive actions where you don't need discretion.

When looking at Expert Advisors, run them on a demo account for at least two to three months. Live demo testing reveals more than any backtest.

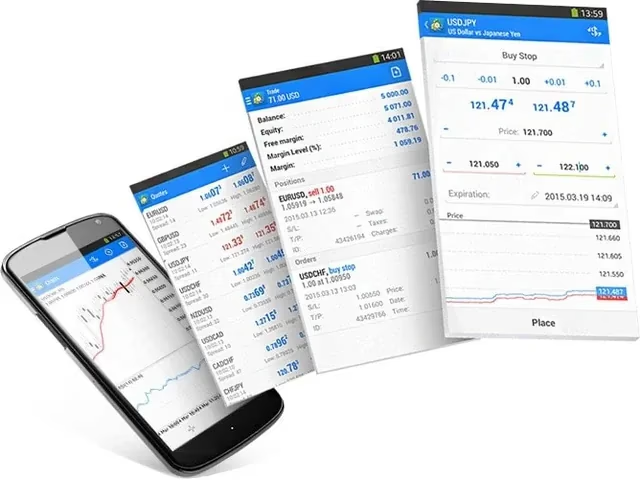

MT4 beyond the desktop

MT4 was built for Windows. Running it on Mac has always been a workaround. The old method was emulation, which was functional but introduced visual bugs and the odd crash. Certain brokers now offer macOS versions using Crossover or similar wrappers, which are better but remain wrappers at the end of the day.

MT4 mobile, on both Apple and Android devices, are genuinely useful for keeping an eye on positions and managing trades on the move. Full analysis on a mobile device is pushing it, but adjusting a stop loss from your phone is worth having.

Look into whether your broker has a native Mac build or just a wrapper — the experience varies a lot between the two.